b&o tax due dates

Here you can check your filing due dates to make sure your tax return gets in on time. We Minimize Your Tax Liability So You Can Keep More of Your Hard-earned Money.

May 1st thru June 15 prepayment.

. Ad Not Sure How to Do Your Taxes. On Any Device OS. Jonathan Wyman CPA Can Handle All Your Tax Needs.

File Returns Pay Taxes. Reporting Period Due Date. With payment of any taxes due by the due date.

Must file and pay taxes quarterly on. The tax amount is based on the value of the manufactured products or by-products. Quarterly payments are due in April July October and January.

5 rows This guide includes information about how to file and pay your taxes regulatory licenses and. Penalty and interest will be applied. It is measured on the value of products gross proceeds of sales or gross income of the business.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. 9 of the tax due if not received on or before the last day of the month in which the. Q1 January - March April 30.

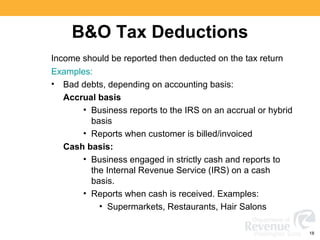

Ad pdfFiller allows users to Edit Sign Fill Share all type of documents online. Gross income includes business activities conducted both. BO tax is a gross receipts tax measured on gross proceeds of sales or gross income for the reporting period.

Q2 April-June July 31. Annual 2022 due date. Monthly returns are due the last day of the month following the tax month eg.

Annual due dates are listed below for the Combined Excise Tax Return. June tax return is due July 31 Quarterly returns are due the end of the month. If received after the last day of the 2 nd month following the due date 29 of tax due For.

Due Dates 2013 - 2018 due dates. Filing due dates Print. Reporting Periods and Due Dates grouped by quarters of the year.

Its important to know when your taxes need to be filed. Penalties and interest are charged as follows. Penalties and interest are due if tax returns are not filed and taxes paid by the due date.

BO Tax returns are due within one month following the end of the taxable quarter. Penalties for late payment. Give it a Try.

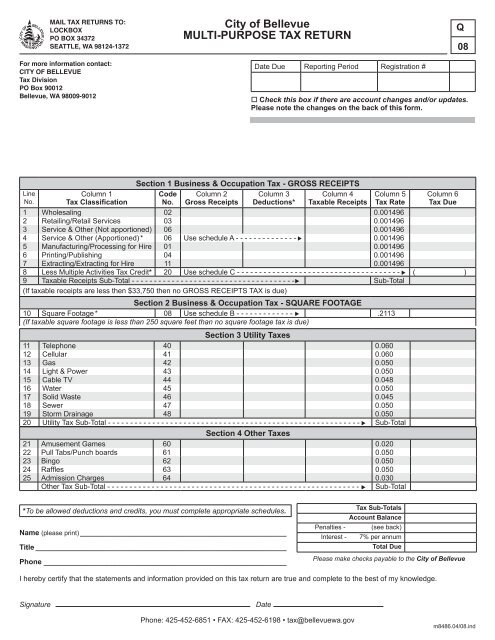

The City Business Occupation BO tax is a gross receipts tax. Additional information and specifics related to your business may be obtained in chapters 403 404 409 410 and 414 of the Bellevue City Code or by contacting the citys Tax Division.

When Are Washington State B O Taxes Due In 2021

Tax Filing Example Washington Department Of Revenue

Business License Tax Seattle Business And Occupation Tax B O Tax Community Business Services Inc Tax And Accounting

Business Occupation Tax Bainbridge Island Wa Official Website

Quarterly Multi Purpose Tax Return City Of Bellevue

When Are Business Taxes Due 2021 Tax Calendar Divvy

When Are Washington State B O Taxes Due In 2021

B Amp O Tax Return City Of Bellevue

Some States 2020 Estimated Tax Payments Due Before 2019 Tax Returns

Due Dates Department Of Taxation

When Are Washington State B O Taxes Due In 2021

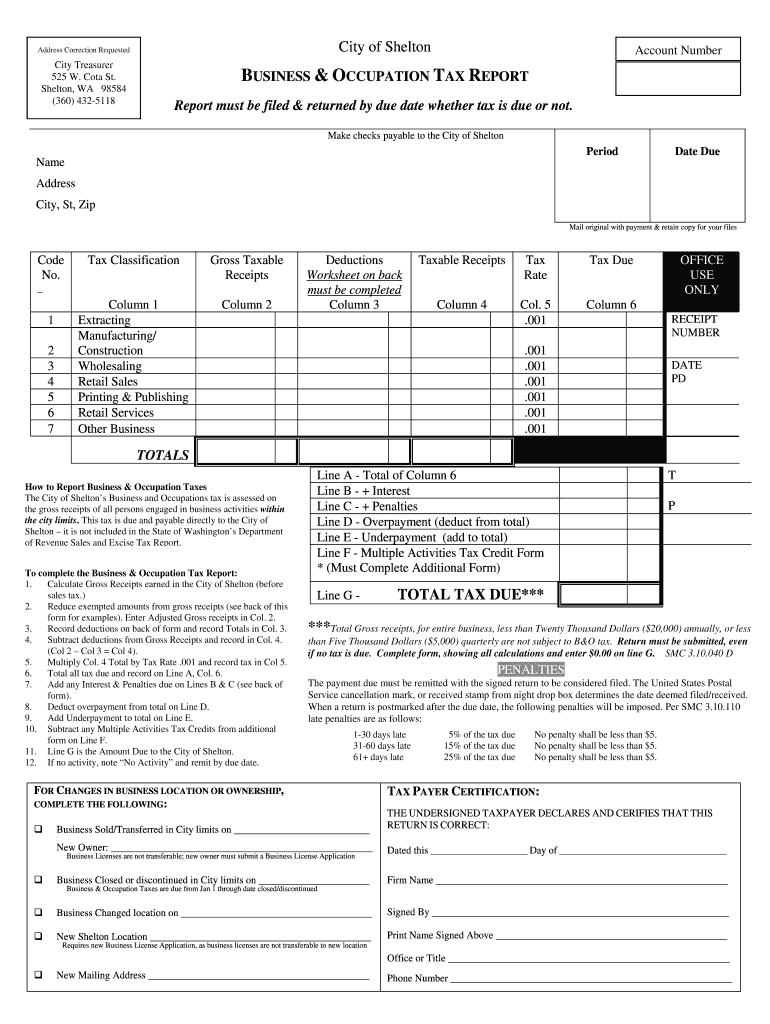

B Amp O Tax Report City Of Shelton Fill Out Sign Online Dochub

Business And Occupation Tax City Of Renton

Tax Season Guide B Seattle Business Apothecary Resource Center For Self Employed Women

Washington Combined Excise Tax Return Fill Out Sign Online Dochub

Washington State Sales Use And B O Tax Workshop

Business And Occupation B O Tax Washington State And City Of Bellingham

Sm Diversity Got A Response Back From City Of Seattle Please See Our Website For Information Regarding Q1 Q2 2020 B O Tax Extensions For Eligible Businesses Http Www Seattle Gov Documents Departments Fas Businesslicensetax Filingextension Pdf